Real-world asset tokenization represents one of the most significant transformations in modern finance, with projections suggesting a $16 trillion market opportunity by 2030. This comprehensive guide explores how blockchain technology is revolutionizing traditional asset ownership and creating new opportunities for investors and institutions alike.

Table of Contents:

- Understanding Real-World Assets (RWAs)

- The RWA Tokenization Revolution

- Process & Types of Tokenized Assets

- Benefits of Asset Tokenization

- Market Size and Growth Potential

- Challenges and Considerations

- The Future of Tokenized Ownership

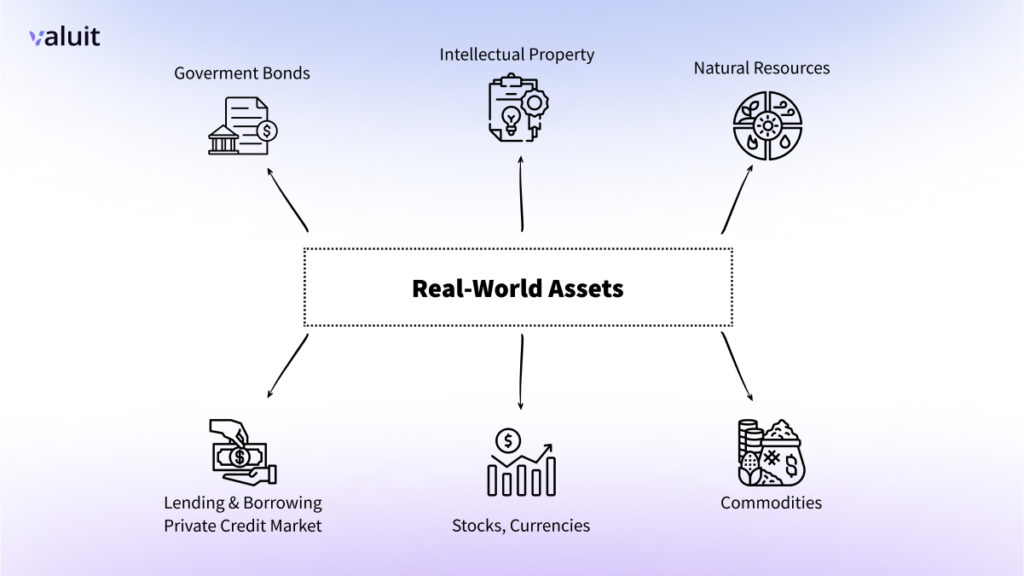

Understanding Real-World Assets (RWA)

At its core, a real-world asset is anything of tangible value in our physical world. Think of your house, the gold bars in a vault, corporate bonds, or even the machinery in a factory. These assets have traditionally been bound by physical constraints – they’re often difficult to divide, slow to transfer, and complicated to trade.

Real-World Assets include:

- Physical assets (real estate, commodities, art)

- Financial instruments (bonds, stocks, currencies)

- Credit and lending products

- Intellectual property

- Natural resources

The RWA Tokenization Revolution

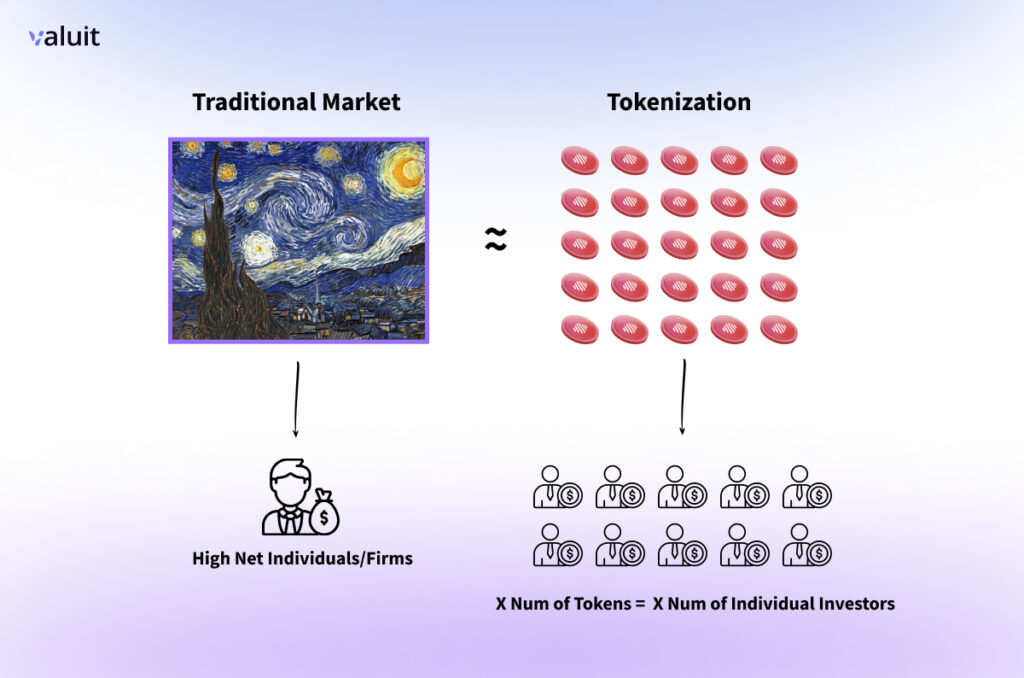

Tokenization is the process of creating a digital representation of a real thing on the blockchain. This transformation is more than just digitization – it is a complete reinvention of how we record, transfer, and manage ownership of assets.

To understand tokenization, imagine a high value painting worth $1 million. Traditionally, only wealthy collectors could afford to invest in such art. Through tokenization, this painting could be divided into 1,000 tokens, each worth $1,000, making fine art investment accessible to a broader audience.

These digitals tokens can be:

- Bought and sold 24/7

- Divided into smaller units (fractionalization)

- Programmed with specific rules and conditions

- Tracked with complete transparency

Larry Fink, the chairperson and CEO of BlackRock, emphasized this transformation in January 2024: “We believe the next step going forward will be the tokenization of financial assets, and that means every stock, every bond… will be on one general ledger.

Process & Types of Tokenized Assets

The Process of Tokenization Works Like This:

- Asset Identification: A real-world asset is selected for tokenization

- Legal Structure: Creation of a legal framework to link the digital token to the physical asset

- Token Creation: Digital tokens are created on a blockchain representing ownership rights

- Smart Contract Implementation: Programming rules and conditions into the tokens

- Distribution: Making tokens available for investment through various platforms

The tokenization landscape spans various asset classes:

Real Estate:

- Individual properties

- Real Estate Investment Trusts (REITs)

- Commercial real estate portfolios

Financial Assets:

- Government bonds

- Corporate debt

- Money market funds

- Equity shares

Commodities:

- Precious metals

- Agricultural products

- Energy resources

- Industrial metals

Private Markets:

- Private equity funds

- Venture capital investments

- Private credit

Benefits of Tokenization

For Investors:

- Enhanced Liquidity : Traditional assets like real estate or fine art often suffer from the “liquidity trap” – they are valuable but difficult to sell quickly. Tokenization solves this by creating a 24/7 global marketplace. Imagine turning your investment in a Manhattan skyscraper as liquid as selling shares in Apple stock.

- Fractional Ownership : Think of tokenization like splitting a pizza into as many slices as you want. A $10 million commercial property can be divided into 10,000 tokens worth $1,000 each, making previously exclusive investments accessible to retail investors.

- Faster Settlement : Traditional asset transfers can take days or weeks. McKinsey analysis indicates that tokenized transactions can reduce settlement times from T+2 (two days) to nearly instant, potentially unlocking about $100 billion in additional annual returns for investors globally.

- Transparency and Security : Every transaction is recorded on the blockchain, creating an immutable audit trail. It is like having a public notary verify every ownership change, but automated and foolproof.

Read : RWA Tokenization: The Bridge Between Traditional Finance and Crypto

For Financial Institutions:

- Operational Efficiency : Smart contracts automate many manual processes, reducing administrative overhead. BlackRock’s tokenized fund BUIDL demonstrated this by achieving over $500 million in assets under management with significantly lower operational costs than traditional funds.

- New Revenue Streams : Banks and financial institutions can create innovative products and services around tokenized assets. For instance, Franklin Templeton’s FOBXX fund introduced 24/7 peer-to-peer transfers, a feature impossible with traditional mutual funds.

- Global Reach : Tokenization breaks down geographical barriers, allowing institutions to reach investors worldwide without establishing a physical presence in each market.

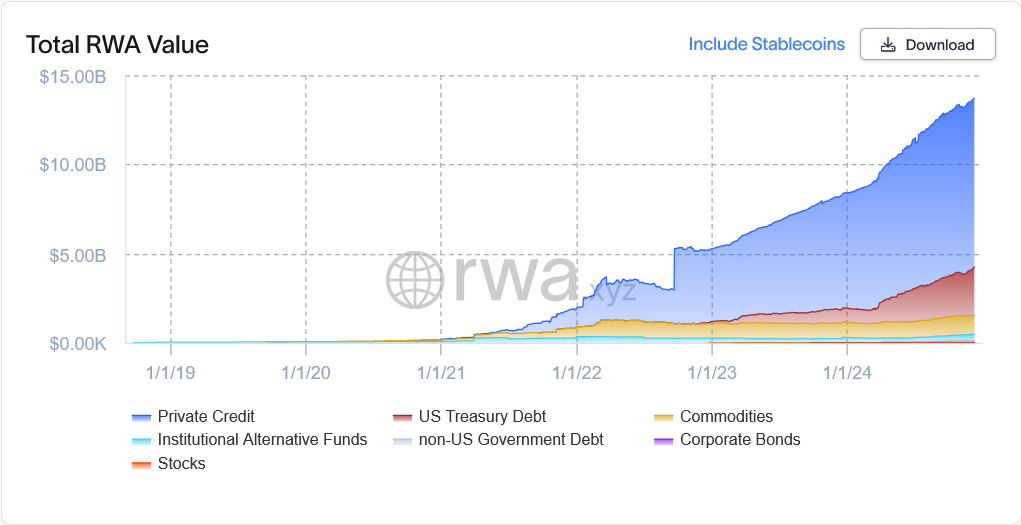

Market Size and Growth Potential

Current Market Statistics (2024): As per RWA.xyz

- Total market size: $186 billion (including stablecoins)

- Market size excluding stablecoins: $13.5 billion

- Year-to-date growth: +32%

- Number of tokenized asset issuers: 150+

- Active blockchains: 20+

Future Projections:

- Boston Consulting Group: $16 trillion by 2030

- McKinsey: $2 trillion by 2030 (excluding cryptocurrencies)

- World Economic Forum: 10% of global GDP by 2027

Challenges and Considerations

- Regulatory Complexity: Establishing legal frameworks to align on-chain tokens with real-world ownership.

- Technology Integration: Ensuring interoperability between blockchains and legacy systems.

- Security Concerns: Preventing fraud and securing smart contracts against vulnerabilities.

Conclusion : Future of Tokenized Ownership

The future of tokenization lies in seamless integration with traditional financial systems, widespread adoption of on-chain data solutions, and innovations in decentralized finance (DeFi). Real-world asset tokenization is not just a trend; it is the foundation for a more inclusive, transparent, and efficient global financial ecosystem.

This blog is part of our 7-part series on RWA. Stay tuned for the next posts where we dive deeper into the new market opportunity.