- Menu

Solutions

Digitize, invest, and manage your portfolio of assets with BlockRidge's blockchain solutions.

Customers

Hear from our clients and partners who are reshaping finance with BlockRidge.

Resources

Explore insights, guides, and tools to navigate the future of finance.

LEARNING

Blogs

Insights and Learning

SUPPORT

FAQs

Frequently Asked Questions

About Us

Learn about the team who is redefining the future of finance

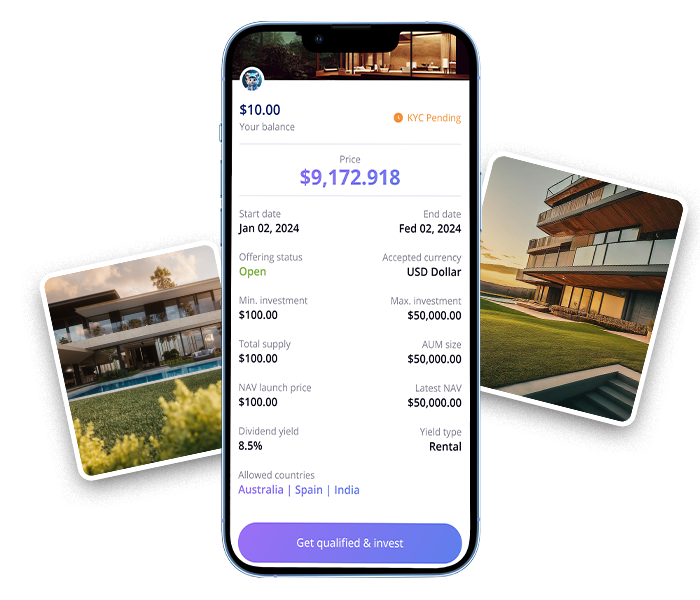

Invest from anywhere in the world

Alternative Financing for a New Era of Equity Management

Overview

BlockRidge’s platform offers a groundbreaking approach to funds and equities, enabling investors and fund managers to explore alternative financing methods through tokenization. By converting traditional equity assets into digital tokens, we provide a new level of liquidity, transparency, and accessibility to a broader range of investors.

Our solutions extend to Exchange-Traded Products (ETPs), offering an innovative way to package and trade tokenized assets on global markets.

Benefits

Increased Liquidity

Tokenizing equity and fund assets enhances their liquidity by allowing them to be traded on secondary markets, giving investors more flexibility.

Diversified Investment Options

With alternative financing options like tokenized ETPs, investors can access a wider range of financial products, creating a more diversified and resilient portfolio.

Transparency and Efficiency

Blockchain technology ensures that all transactions are fully transparent and efficient, reducing the need for intermediaries and streamlining the investment process.

Global Accessibility

Tokenization opens up access to global markets, allowing investors from around the world to participate in equity and fund investments that were previously inaccessible.

Funds & Equities

How It Works?

Strategic Asset Analysis

Assessment & Structuring: Before tokenizing your equity or fund assets, BlockRidge’s team conducts a thorough analysis to identify the best financial structures and strategies for maximizing the potential of these assets in digital markets.

Asset Onboarding and Verification

Verification & Documentation: Upload and verify your equity or fund assets on BlockRidge’s secure platform. This includes providing essential documents, such as ownership proofs, fund performance records, and compliance certificates, to ensure that the tokenization process is smooth and secure.

Token Creation

Digital Token Generation: BlockRidge converts your equity or fund assets into digital tokens, representing fractional ownership and enabling a new level of flexibility in how these assets are traded and managed.

Compliance and Regulatory Adherence

Automated Compliance Checks: Our platform ensures that all tokenized assets meet the regulatory standards of the jurisdictions in which they will be traded, covering essential requirements like AML and KYC protocols.

Marketplace Listing and Trading

Global Marketplace Integration: Once compliance is confirmed, your tokens are listed on BlockRidge’s global marketplace, allowing them to be traded by investors around the world, enhancing liquidity and market access.

Active Management and Portfolio Monitoring

Real-Time Management: Use BlockRidge’s intuitive dashboard to monitor the performance of your tokenized funds and equities, manage trades, and engage with investors in real-time, ensuring optimal asset performance.

Compliance and Security

Blockchain-Based Security

Our platform leverages the security of blockchain technology to ensure that all transactions involving your tokenized assets are transparent, secure, and immutable. Each transaction is recorded on the blockchain, creating a permanent and tamper-proof ledger.

Smart Contract Automation

BlockRidge employs smart contracts to automate various aspects of asset management, including compliance checks, dividend distributions, and portfolio rebalancing. These contracts execute automatically based on predefined conditions, minimizing risks and enhancing efficiency.

Data Encryption and Protection

We prioritize the security of your data with advanced encryption methods, safeguarding your documents, transaction history, and personal information from unauthorized access.

Continuous Risk Monitoring

Our platform is equipped with continuous security monitoring tools to detect and mitigate potential risks in real-time, ensuring that your tokenized funds and equities are always protected.

Ready to Explore New Avenues in Funds and Equities?

Get Started with Tokenization: Begin your journey towards enhanced liquidity and global market access today.