Limited Offer

👋

Lorem Ipsum is simply dummy text of the printing and

Limited Offer

Lorem Ipsum is simply dummy text of the printing and

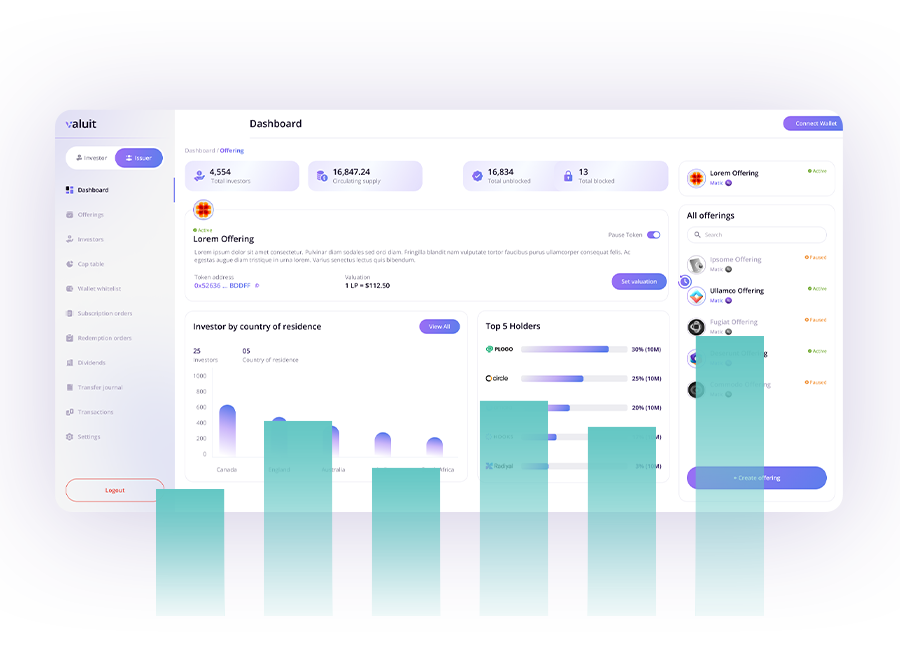

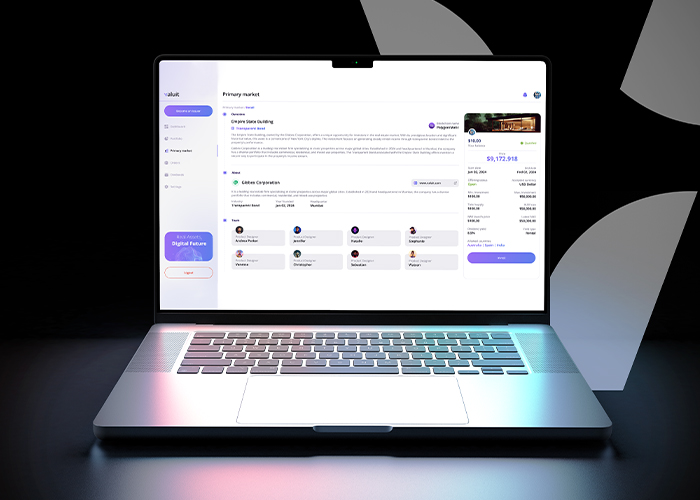

Digitize, invest, and manage your portfolio of assets with Valuit's blockchain solutions.

Hear from our clients and partners who are reshaping finance with Valuit.

Explore insights, guides, and tools to navigate the future of finance.

LEARNING

Blogs

Insights and Learning

SUPPORT

FAQs

Frequently Asked Questions

Learn about the team who is redefining the future of finance

Valuit’s Debt Financing solutions enable businesses to access capital through the innovative use of tokenized debt instruments. By converting traditional debt into digital tokens, we provide an efficient and secure way to issue, structure, and manage debt, offering greater flexibility and market reach.”

“Our platform supports the issuance of bonds, notes, and other debt securities, making it easier for businesses to raise capital while offering investors a transparent and liquid marketplace for trading these instruments.

Tokenized debt instruments can be traded on secondary markets, providing liquidity that is often lacking in traditional debt financing.

By leveraging blockchain technology, we enable businesses to access a global pool of investors, expanding the reach of debt offerings.

The automation of debt issuance and management processes reduces administrative overhead and ensures that all transactions are transparent and auditable.

Valuit offers customizable debt instruments tailored to meet the specific needs of your business, ensuring that your capital-raising strategy is aligned with your financial goals.

Assessment & Customization: Valuit’s team begins by analyzing your capital needs and financial structure to design the most effective debt instruments for your business. Whether issuing bonds, notes, or other debt securities, we tailor the structure to align with your specific goals.

Verification & Documentation: Once the debt structure is finalized, you securely upload and verify all relevant documentation on Valuit’s platform. This includes legal agreements, financial statements, and other necessary documentation, ensuring that your debt issuance process is fully compliant.

Digital Token Generation: Valuit converts your debt instruments into digital tokens, representing the value and terms of each instrument. These tokens are then ready for issuance, making it easier for investors to participate in your debt offering.

Automated Compliance Checks: Before your tokens are listed on the marketplace, they undergo a thorough compliance check to ensure adherence to local and international regulations, including securities laws and anti-money laundering (AML) protocols.

Global Marketplace Integration: Your tokenized debt instruments are listed on Valuit’s marketplace, providing access to a global network of investors. This enhances liquidity and allows your debt instruments to be traded in real-time.

Real-Time Tracking: Use Valuit’s intuitive dashboard to manage your debt instruments, track performance, and engage with investors. The platform provides real-time data and insights, enabling you to make informed decisions about your capital structure.

Valuit’s platform is built on a comprehensive compliance framework that ensures all tokenized debt instruments adhere to the regulatory standards of the jurisdictions in which they are issued and traded. This includes compliance with securities laws, AML requirements, and know your customer (KYC) protocols, ensuring that your debt issuance process is legally sound.

By utilizing blockchain technology, Valuit ensures that all transactions involving your tokenized debt instruments are secure, transparent, and immutable. Each transaction is recorded on the blockchain, providing a permanent and tamper-proof record.

Our platform uses smart contracts to automate key aspects of the debt issuance process, including compliance checks, interest payments, and redemption schedules. These contracts execute automatically based on predefined conditions, reducing the risk of human error and enhancing operational efficiency.

Valuit prioritizes the security of your data by employing advanced encryption methods to protect all information related to your debt instruments, ensuring that your documents, transaction history, and personal data are secure from unauthorized access.

Our platform is equipped with real-time security monitoring tools that detect and respond to potential threats, ensuring that your debt instruments remain protected throughout their lifecycle.

Discover how Valuit’s platform can revolutionize your approach to debt issuance and structuring. Whether you’re looking to raise capital through bonds, notes, or other debt securities, our tokenized solutions offer the liquidity, transparency, and global reach you need to succeed.

Adding {{itemName}} to cart

Added {{itemName}} to cart