Table of Contents

- What is Tokenization?

- Understanding Real-World Assets (RWAs)

- The Underlying Infrastructure

- How Tokenization Works

Part 1 : What is RWA Tokenization – Everything that you need to know!

What is Tokenization?

Tokenization is the process of creating a digital representation of a real-world asset on a blockchain. This transformation converts rights to an asset into a digital token that can be easily managed, transferred, and traded. Think of it as converting a paper stock certificate into a digital version that can be instantly transferred and tracked on a secure digital ledger.

Understanding Real-World Assets (RWAs)

Real-world assets (RWAs) in blockchain are digital tokens that represent physical and traditional financial assets. These can include:

- Financial instruments (stocks, bonds, funds)

- Physical assets (real estate, commodities, art)

- Cash and currencies

- Intellectual property

- Revenue streams

The global market for tokenized RWAs is growing rapidly, with projections suggesting it could reach $16 trillion by 2030.

The Underlying Infrastructure

A. Blockchain

A blockchain is essentially a digital ledger that records transactions across a network of computers. Key features include:

- Decentralized structure (no single point of control)

- Immutable records (cannot be altered once recorded)

- Transparent transactions

- Secure cryptographic protection

In tokenization, blockchain provides the underlying infrastructure that ensures security, transparency, and trust in digital asset ownership and transfers.

B. Smart Contracts

Smart contracts are self-executing programs stored on a blockchain that automatically enforce and execute the terms of an agreement. They serve as the foundation for tokenization by:

- Managing token creation and distribution

- Enforcing trading rules

- Automating compliance

- Handling ownership transfers

- Managing asset-specific functions

ERC-20 and ERC-3643 are pivotal Ethereum token standards that make tokenization possible, each serving unique but complementary purposes in the blockchain ecosystem.

ERC-20: The Foundation of Fungible Tokens

ERC-20 is the original standard that revolutionized token creation on the Ethereum blockchain. Introduced in 2015, it provides a standardized framework for creating fungible tokens – where each token is identical and interchangeable with another. Key characteristics include:

- Uniform interface for token interactions

- Consistent set of rules for token implementation

- Seamless integration with wallets and exchanges

- Enables easy transfer and management of tokens

- Supports basic functionalities like balance checking, token transfers, and total supply tracking

While ERC-20 was groundbreaking, it had limitations when it came to representing more complex, regulated assets with specific compliance requirements.

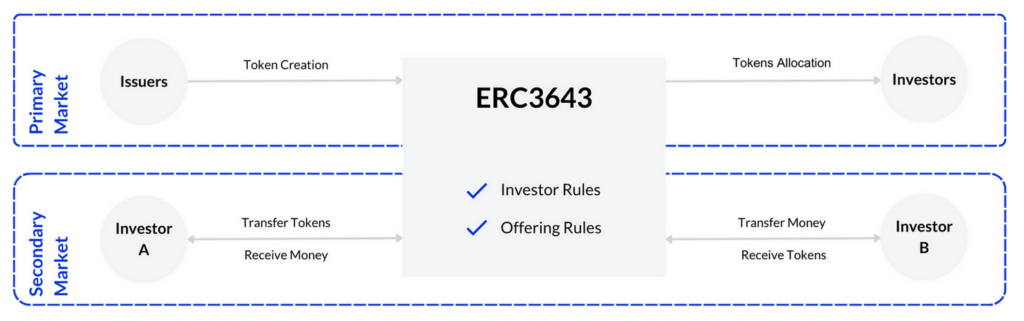

ERC-3643: Advanced Tokenization for Regulated Assets

ERC-3643 addresses the compliance and regulatory challenges of tokenizing real-world assets. It introduces:

- Built-in compliance and identity management

- Permissioned transfers with on-chain verification

- Ability to implement complex transfer rules

- Support for regulatory requirements

- Enhanced security for financial and sensitive asset tokenization

Unlike ERC-20’s simple transferability, ERC-3643 allows for:

- Investor whitelisting

- Geographical restrictions

- Automated compliance checks

- Granular control over token movements

These standards work together to create a robust ecosystem for asset tokenization. ERC-20 provides the basic infrastructure, while ERC-3643 adds the sophisticated compliance layer necessary for representing real-world, regulated assets on the blockchain.

So, how does tokenization actually work?

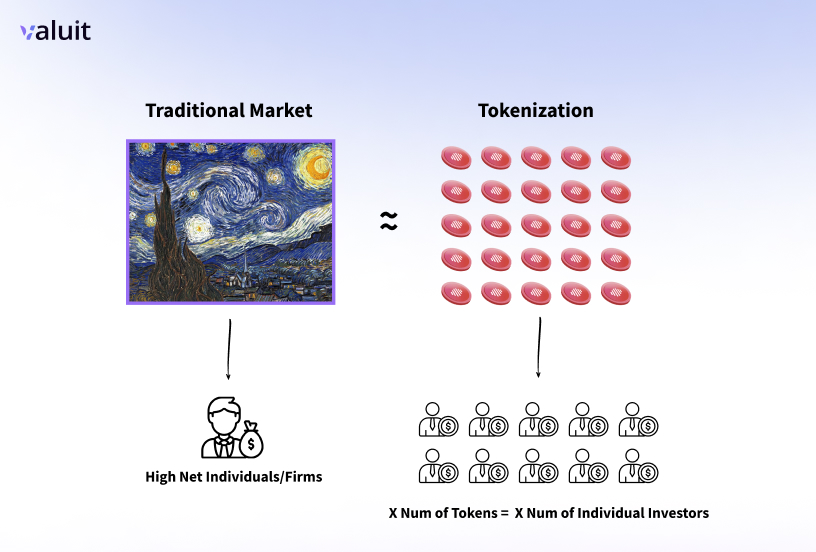

Imagine turning a $10 million painting into 10 million digital “shares” worth $1 each, which anyone could buy, sell, or trade & transfer the assets instantly – that’s tokenization in action. Let’s take you through the real world asset’s tokenization journey at BlockRidge.

Steps of Assets Tokenization

1. Asset Identification & Evaluation

2. Legal structuring & SPV Formation

3. Audit & Compliance

4. Token Creation & Documentation

5. Token Issuance Protocol

6. Market Integration & Liquidity

7. Assets Management Suite

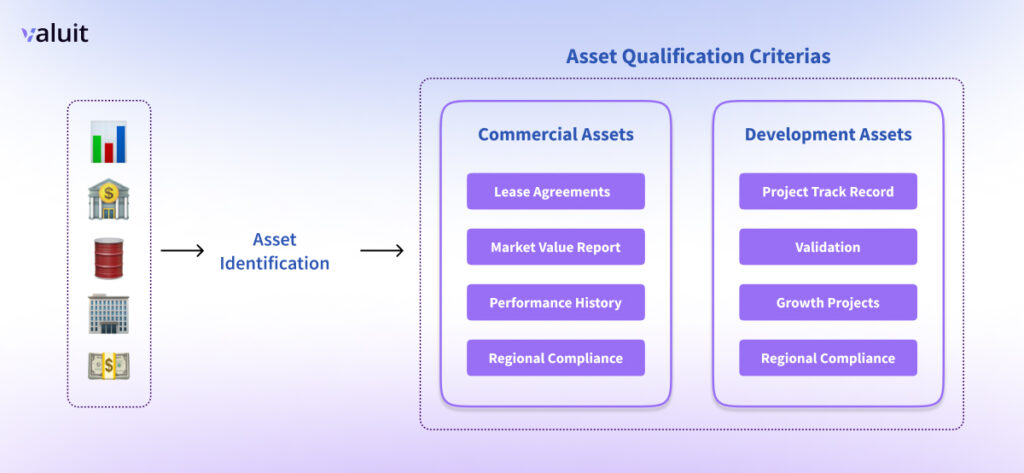

1. Asset Identification & Evaluation

➜ Identifying eligible asset for tokenization (real estate, commodities, private equity, etc.)

➜ Verifying that assets meets BlockRidge’s requirements:

- Commercial Assets: BlockRidge rigorously evaluates properties with active lease agreements, verified market value, and proven performance history, ensuring compliance across EU, CIS, MENA, SEA, and LATAM regions.

- Development Assets: The assessment focuses on project track record, market validation, and compelling growth projections to identify tokenization-worthy development opportunities with strong potential for investor returns.

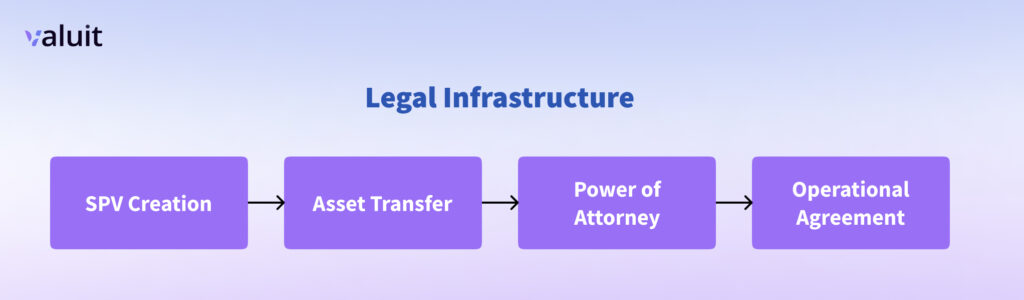

2. Legal structuring & SPV Formation

➜ Register a Special Purpose Vehicle (SPV) in an EU country

➜ Transfer asset ownership to the SPV with official filing in local government

➜ Asset owner provides Power of Attorney to BlockRidge for Share Capital Management

➜ Establish operating agreement outlining: – Governance structure – Operational procedures – Share transfer rules – Shareholder registry information

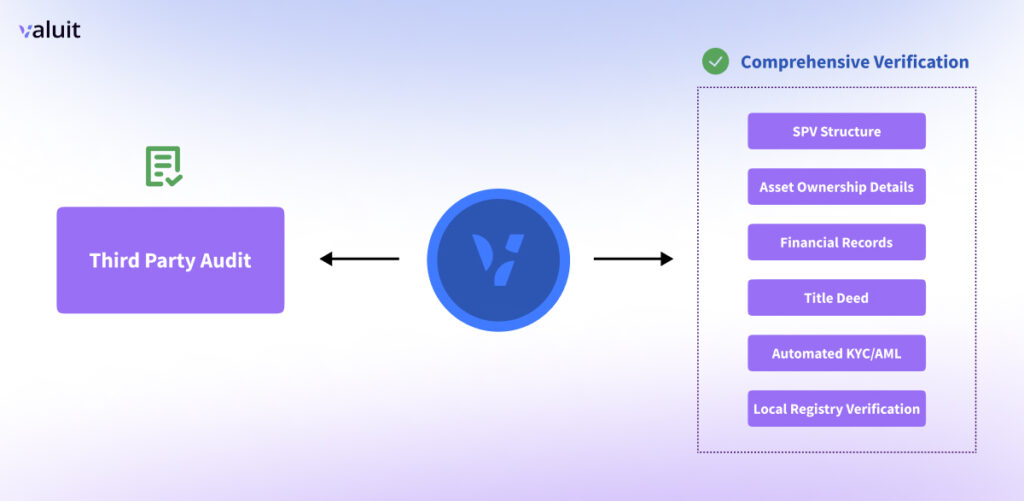

3. Audit & Compliance

➜ Third-party audit conducted by firms

➜ Comprehensive verification of

– SPV structure

– Asset ownership details

– Financial records

– Title deed

➜ Automated KYC/AML checks

➜ Verification with local registry for ownership/deed/title transfer

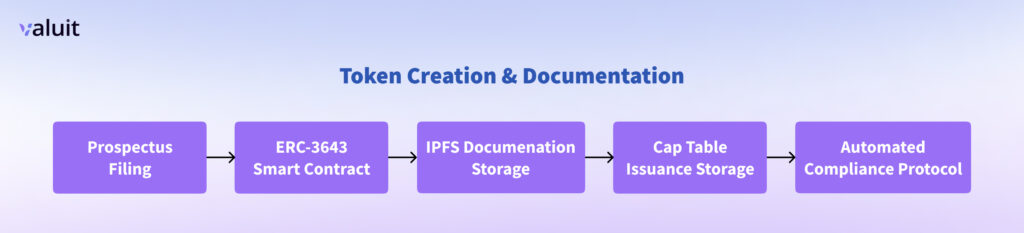

4. Token Creation & Documentation

➜ File prospectus for share issuance and token minting

➜ Deploy ERC-3643 smart contracts using BlockRidge’s no-code solution

➜ Store documentation on IPFS for on-chain verification

➜ Setup cap table issuance system

➜ Implement automated compliance enforcement protocols

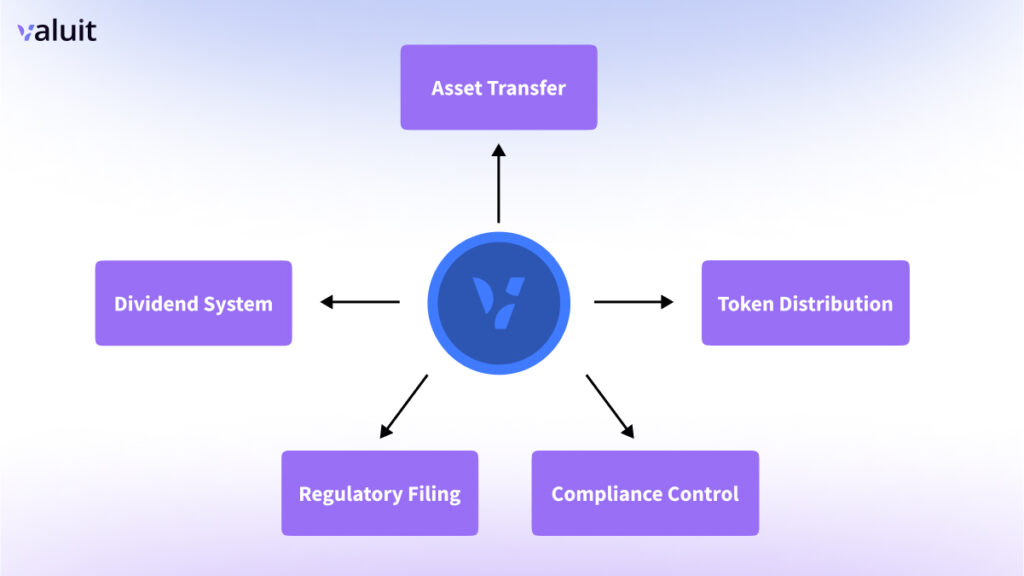

5. Token Issuance Protocol

➜ Transfer ownership of tokenized assets back to original asset holders through BlockRidge’s Token Hub

➜ Regulatory filing

➜ Token distribution

➜ Enable compliance controls and token transfer restrictions

➜ Dividend mechanism implementation

6. Market Integration & Liquidity

➜ Major DEXs (UniSwap, Aerodrome)

➜ Regulated CEXs

➜ DeFi protocols (Aave, Balancer)

➜ Custom liquidity pools

➜ Yield optimization engines

7. Assets Management Suite

➜ Monitor and maintaining regulatory compliance.

➜ Manage share capital.

➜ Handle corporate actions (dividends, voting).

➜ Provide real-time documentation updates.

➜ Maintain KYC/AML compliance.

➜ Execute automated compliance checks for all transfers.

➜ Generate regular performance reports.

Conclusion

Real-world asset tokenization is revolutionizing how we perceive ownership, accessibility, and liquidity of traditional assets. By leveraging blockchain technology, this process brings efficiency, transparency, and compliance to previously fragmented markets. As adoption grows, RWAs are poised to unlock immense value and reshape global finance.

This is the second blog in our Real-World Asset (RWA) Tokenization series, where we tried explaining how RWA Tokenization works. Stay updated on everything RWA by following us on our socials :