Introduction

The ERC-3643 token standard addresses a specific problem in blockchain implementation: bringing regulatory compliance to tokenized real-world assets (RWA). This Ethereum standard enables financial institutions and asset issuers to tokenize securities, property rights, and other regulated assets by integrating compliance verification directly within the token’s code. Unlike more common token standards, ERC-3643 verifies participant eligibility before allowing token transfers, making it particularly suitable for assets subject to legal oversight.

Blog knowledge source : https://docs.erc3643.org/erc-3643

Technical Foundation of ERC-3643 for RWA Tokenization

ERC-3643 consists of a suite of smart contracts that create permissioned tokens – tokens that require identity verification before transactions can occur. While standard ERC-20 tokens allow transfers between any two addresses without restriction, ERC-3643 tokens first verify whether both sender and receiver meet predetermined compliance criteria.

The protocol implements identity verification through a system called ONCHAINID, which connects blockchain addresses to verified digital identities. This solves a fundamental limitation of blockchain for regulated industries: the anonymity of traditional cryptocurrency addresses. With ERC-3643, financial institutions can issue tokens representing regulated assets like securities, debt instruments, or ownership rights while maintaining required oversight and compliance with jurisdictional regulations.

Core Technical Components of ERC-3643

Identity Verification System

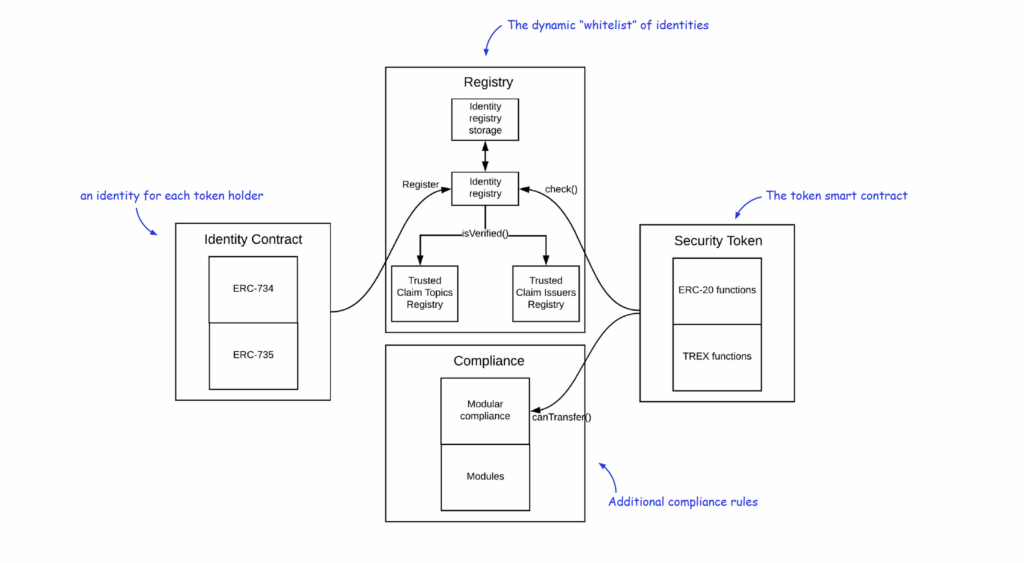

ERC-3643’s architecture solves specific regulatory requirements through several interconnected components:

- ONCHAINID Implementation: Each participant receives a unique digital identity contract deployed on the blockchain. This contract stores verification credentials issued by trusted authorities who have performed KYC/AML checks. The system links multiple wallet addresses to a single identity, preventing regulatory circumvention through wallet switching.

- Transfer Manager: This component intercepts all token transfer requests and queries the identity contracts of both sender and receiver. It verifies specific credentials (like investor accreditation status, residency restrictions, or transaction limits) before executing transfers.

- Modular Compliance Rules: Issuers can implement jurisdiction-specific rules as discrete code modules. For example, a token might include modules for SEC Regulation D compliance in the US, while simultaneously incorporating MiFID II requirements for European investors.

- Token Forensics: Unlike privacy-focused cryptocurrencies, ERC-3643 maintains complete transaction traceability, allowing issuers to generate regulatory reports, enforce investor concentration limits, or freeze suspicious transactions.

ONCHAINID: Technical Implementation Details

The wallet-based compliance approach fails because one person can create unlimited blockchain addresses. ERC-3643 solves this through the ONCHAINID system with specific technical features:

- Contract-Based Identity: Each identity exists as an autonomous smart contract with its own storage and logic, functioning as a digital representation of the person or entity controlling it.

- Claim Verification Model: Third-party verifiers (banks, KYC providers, government agencies) issue cryptographically signed attestations stored within the identity contract. These claims contain specific verification data like “US Accredited Investor Status Verified” or “FATF Travel Rule Compliant.”

- Claim Registry Architecture: The protocol maintains registry contracts recording which verification providers are authorized for different claim types. Token issuers can specify which verification providers they accept for their specific compliance requirements.

Real World Asset Tokenization Implementation Using ERC-3643

ERC-3643 addresses specific technical and regulatory requirements for transforming physical and financial assets into blockchain tokens:

Asset Class-Specific Implementation Requirements

ERC-3643 implementations vary based on the underlying asset’s regulatory requirements:

- Securities Integration: Connects with existing securities depositories and transfer agents to maintain legal ownership records while adding token-based transfer efficiency.

- Real Estate Tokenization: Incorporates property record verification and tracks fractional ownership with automatic distribution of rental income or proceeds.

- Debt Instruments: Manages coupon payments, maturity dates, and creditor rights through programmable token behaviors.

- Physical Commodities: Links with custody verification systems to ensure tokens represent actual physical reserves.

Technical Solutions to RWA Tokenization Challenges

ERC-3643 resolves specific implementation issues through its architecture:

- Token Recovery Mechanism: Unlike self-custodied cryptocurrencies, ERC-3643 includes identity-based recovery options to restore access when private keys are lost, addressing a major institutional adoption barrier.

- Multi-level Access Controls: Tokens can implement hierarchical permission structures for administrator functions like forced transfers for court orders, investor caps, or other regulatory-mandated interventions.

- Legal Documentation Integration: Token contracts can include cryptographic hashes of corresponding legal agreements, prospectuses, or offering documents, creating immutable links between on-chain tokens and off-chain legal frameworks.

- Cross-Chain Implementation: While initially developed for Ethereum, ERC-3643 implementations now exist on multiple EVM-compatible blockchains, allowing issuers to select networks based on transaction costs, finality time, and consensus mechanism.

Quantifiable Advantages of ERC-3643 Implementation

Measurable Benefits for Asset Issuers

- Compliance Cost Reduction: Studies indicate 30-50% reduction in ongoing compliance monitoring costs through automation of investor eligibility verification.

- Settlement Time Compression: Trades settle in minutes rather than T+2 or T+3 cycles required in traditional systems, reducing counterparty risk exposure.

- Capital Requirement Efficiency: Lock-up periods and transfer restrictions can be programmatically enforced with 100% reliability, eliminating manual monitoring.

- Audit Trail Automation: Complete transaction history maintained on-chain reduces audit preparation time by an estimated 60-80% compared to traditional record-keeping.

Specific Improvements for Investors

- Secondary Market Access: Creates standardized infrastructure for regulated secondary trading of traditionally illiquid assets.

- Reduced Minimum Investment Thresholds: Fractional ownership enables participation with smaller capital amounts while maintaining compliance requirements.

- Automatic Regulatory Updates: Identity credentials can be updated by verification providers without requiring investors to repeat verification processes.

- Cross-Border Investment Simplification: Once verified, investors can participate in multiple offerings across jurisdictions that accept their verification credentials.

Understand how Valuit implements tokenization : Click Here

Implemented Use Cases of ERC-3643 for RWA Tokenization

Regulated Security Token Issuance

Several financial institutions have deployed ERC-3643 to issue regulatory-compliant security tokens with specific technical advantages:

- Automated dividend distribution based on token ownership snapshots

- Integrated shareholder voting with immutable voting records

- Enforced holding periods for Regulation D offerings

- Built-in reporting for tax authorities

Commercial Real Estate Tokenization

ERC-3643 implementations for real estate address specific industry requirements:

- Integration with property management systems for automatic rent distribution

- Maintenance reserve fund allocation through smart contract logic

- Investor qualification verification specific to real estate securities

- Implementation of REIT-specific distribution requirements and investor limits

Structured Financial Products

Advanced implementations include:

- Collateralized Loan Obligations with automated waterfall payment structures

- Asset-backed securities with real-time underlying asset performance reporting

- Structured notes with programmable payoff profiles and built-in derivatives

- Private credit facilities with automated covenant monitoring

Technical Roadmap for ERC-3643 and RWA Tokenization

The ERC-3643 standard continues to evolve in response to specific market needs and regulatory developments:

Current Development Focus Areas

- DeFi Integration: Establishing secure bridges between permissioned ERC-3643 tokens and decentralized finance protocols through compliance-aware lending and liquidity pools.

- Layer 2 Implementation: Adapting the protocol for Ethereum Layer 2 scaling solutions to reduce transaction costs while maintaining compliance capabilities.

- Zero-Knowledge Compliance: Implementing selective disclosure credentials using zero-knowledge proofs to enhance privacy while maintaining regulatory compliance.

- Legal Entity Identifier (LEI) Integration: Connecting ONCHAINID with global LEI systems to standardize institutional identity verification.

Conclusion

ERC-3643 provides specific technical solutions to the regulatory requirements of real world asset tokenization. By implementing identity verification directly within token transfers, the standard enables regulated institutions to leverage blockchain efficiency while maintaining necessary compliance controls.

The protocol’s separation of identity verification from the tokens themselves creates a reusable compliance infrastructure that reduces redundant KYC processes. For institutions implementing RWA tokenization projects, ERC-3643 offers a technically mature solution with deployed use cases across multiple asset classes.

As traditional finance increasingly adopts blockchain technology for asset tokenization, standards like ERC-3643 that directly address regulatory requirements will become increasingly important infrastructure components for bridging traditional and decentralized finance.