Table of Contents

- The Rise of Real World Asset Tokenization.

- Understanding RWA Tokenization.

- Types of Assets You Can Tokenize.

- Benefits of Tokenizing Commodities, Real Estate, and Private Equity.

- How to Tokenize Your Assets?

- Challenges and How Valuit Solves Them.

- Conclusion.

The Rise of Real World Asset Tokenization

The financial world is experiencing a paradigm shift. Real World Asset (RWA) tokenization is revolutionizing how we think about ownership and investment. As we progress through 2025, the market for tokenized assets continues to expand, with estimates suggesting it could reach $30 trillion by the end of the decade. This transformation isn’t just about digitizing assets — it’s about democratizing access to investments that were previously available only to a select few.

Understanding RWA Tokenization

RWA tokenization transforms traditional assets into digital tokens on a blockchain network. But what does this really mean? Imagine owning a large office building. Traditionally, you’d either own it entirely or structure complex legal agreements for partial ownership. With tokenization, that same building can be divided into thousands of digital tokens, each representing a portion of the property’s value and rights.

These tokens are secured by blockchain technology, ensuring transparency and immutability of ownership records. When you tokenize an asset with Valuit, you’re essentially creating a digital bridge between the physical and digital worlds, backed by robust legal frameworks and smart contracts.

Types of Assets You Can Tokenize

Real Estate

The real estate sector has emerged as one of the most promising areas for tokenization. Valuit enables tokenization of:

- Commercial properties: Office buildings, retail spaces, and industrial facilities

- Residential buildings: Apartment complexes, housing developments

- Development projects: Pre-construction investments

- REITs: Digital representations of Real Estate Investment Trusts

- Fractional holiday homes: Shared ownership of vacation properties

Commodities

Commodity tokenization opens up new possibilities for trading and investment:

- Precious metals: Gold, silver, platinum with direct digital representation

- Agricultural products: From coffee beans to grain futures

- Energy resources: Oil, natural gas, and renewable energy credits

- Industrial metals: Copper, aluminum, and rare earth elements

- Carbon credits: Tokenized environmental assets

Private Equity

Transform private investments into liquid digital assets:

- Company shares: Private company equity tokens

- Venture capital investments: Start-up portfolio tokens

- Private fund units: Tokenized fund participation

- Start-up equity: Early-stage investment opportunities

- Revenue sharing agreements: Tokenized future revenue streams

Benefits of Tokenizing Commodities, Real Estate, and Private Equity

Increased Accessibility

Tokenization democratizes access to high-value assets, enabling small investors to own a share of billion-dollar properties or commodities with minimal capital.

Enhanced Liquidity

Tokens can be traded 24/7 on blockchain platforms, unlike traditional assets that often suffer from liquidity issues.

Transparency and Security

Blockchain technology ensures that all transactions are secure, transparent, and tamper-proof. Every token’s history and ownership are recorded on an immutable ledger.

How to Tokenize Your Assets?

Whether you’re looking to tokenize real estate, commodities, or private equity, the fundamental process remains similar. Here’s your step-by-step guide to successful asset tokenization:

1. Choose the Right Platform

The first step in tokenizing any asset is selecting the right platform. A robust platform ensures scalability, security, and compliance while offering the necessary tools to manage the tokenization lifecycle effectively. Evaluate platforms based on features like blockchain integration, regulatory alignment, and ease of use.

2. Strategic Deal Structuring

Once a platform is chosen, the next step is structuring the tokenization process. This involves a detailed analysis of the asset’s value, its market potential, and the best financial instruments to represent it as tokens. Proper structuring ensures that the tokenized asset appeals to investors and meets industry standards.

3. Secure Asset Onboarding

Asset onboarding involves securely uploading and verifying the asset’s details. This step includes documenting ownership, conducting due diligence, and ensuring that all necessary legal frameworks are in place to back the digital tokens.

4. Token Generation

After onboarding, the asset is digitally transformed into tokens using blockchain technology. These tokens represent fractional ownership, enabling investors to purchase and trade smaller portions of the asset. Smart contracts are often used to automate terms like profit distribution and voting rights.

5. Compliance Verification

Tokens must adhere to local and international regulatory requirements. Automated compliance checks ensure that all aspects of the tokenization process, from asset representation to trading, meet legal standards. This step is crucial to building investor trust and maintaining market integrity.

6. Marketplace Integration

Once compliant, tokens are listed on a marketplace or trading platform where they can be accessed by investors. Integration with a global marketplace expands the asset’s visibility and liquidity, attracting a diverse investor base.

7. Active Management and Trading

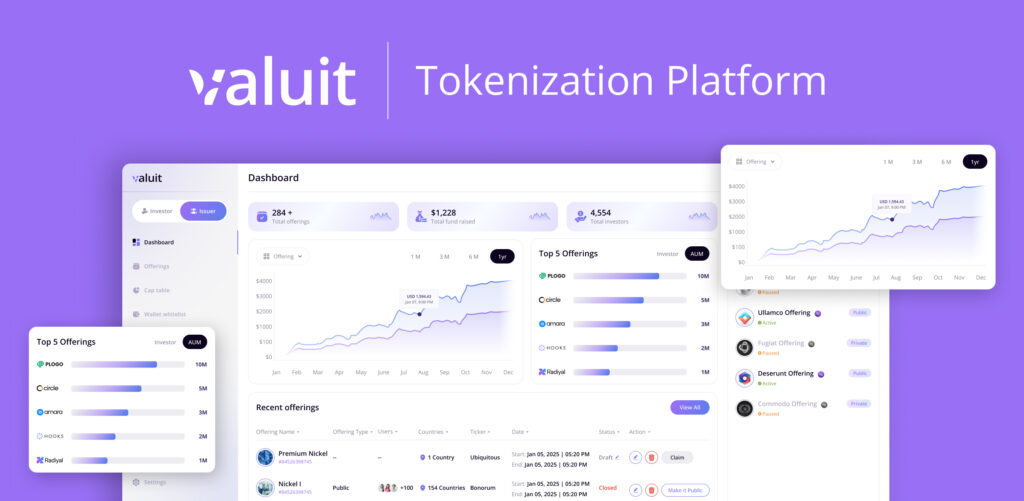

After tokenization, asset management becomes seamless. Platforms typically offer intuitive dashboards to track token performance, manage trades, and monitor investor activity in real time. This ensures continued engagement and efficient handling of tokenized assets.

Choosing the right platform is critical because it sets the foundation for the entire tokenization process. The platform’s capabilities directly impact compliance, transparency, and market accessibility. A trusted partner like Valuit can streamline this journey, offering end-to-end support, from platform selection to asset management, ensuring a smooth and successful tokenization experience.

Learn more about our approach to asset tokenization : https://valuit.com/how-real-world-assets-tokenization-works/

Challenges and How Valuit Solves Them

Regulatory Compliance

Navigating complex regulations can be challenging. Valuit ensures compliance with local and international laws, making tokenization legally secure.

Technical Implementation

Tokenization requires robust technical infrastructure. Valuit’s advanced blockchain solutions provide seamless and secure tokenization processes.

Asset Verification

Ensuring the real-world asset’s authenticity is critical. Valuit uses advanced auditing and third-party verification to guarantee the asset’s integrity.

What sets our process apart:

- End-to-end Solution: From initial structuring to active trading, everything happens within our secure ecosystem

- Expert Support: Our team guides you through each step, ensuring optimal outcomes

- Automated Compliance: Built-in regulatory checks and updates

- Global Reach: Access to international investors through our marketplace

- Advanced Security: Enterprise-grade protection for your assets

- Real-time Management: Comprehensive dashboard for ongoing control

Conclusion

Tokenization is reshaping how we invest in and manage real-world assets. By fractionalizing high-value assets, increasing liquidity, and ensuring transparency, tokenization opens up new opportunities for investors and asset owners alike. Valuit is here to guide you through this transformative journey, offering the expertise and tools needed to succeed in the tokenized economy of 2025 and beyond.

Stay updated on everything RWA by following us on our socials :